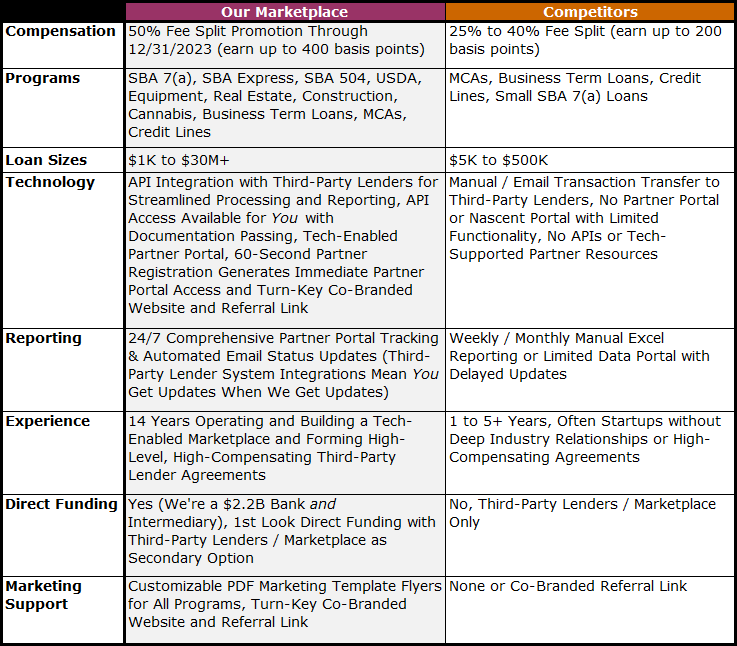

Now until December 31, 2023, approved partners can unlock industry-leading earnings accessing South End Capital’s marketplace revenue share promotion. ST. CLOUD, MINNESOTA, UNITED STATES, November 2, 2023 /EINPresswire.com/ — South End Capital, the partnership-driven arm of Stearns Bank N.A., is excited to announce the extension of a groundbreaking promotion that is reshaping the earning potential for lending [...]

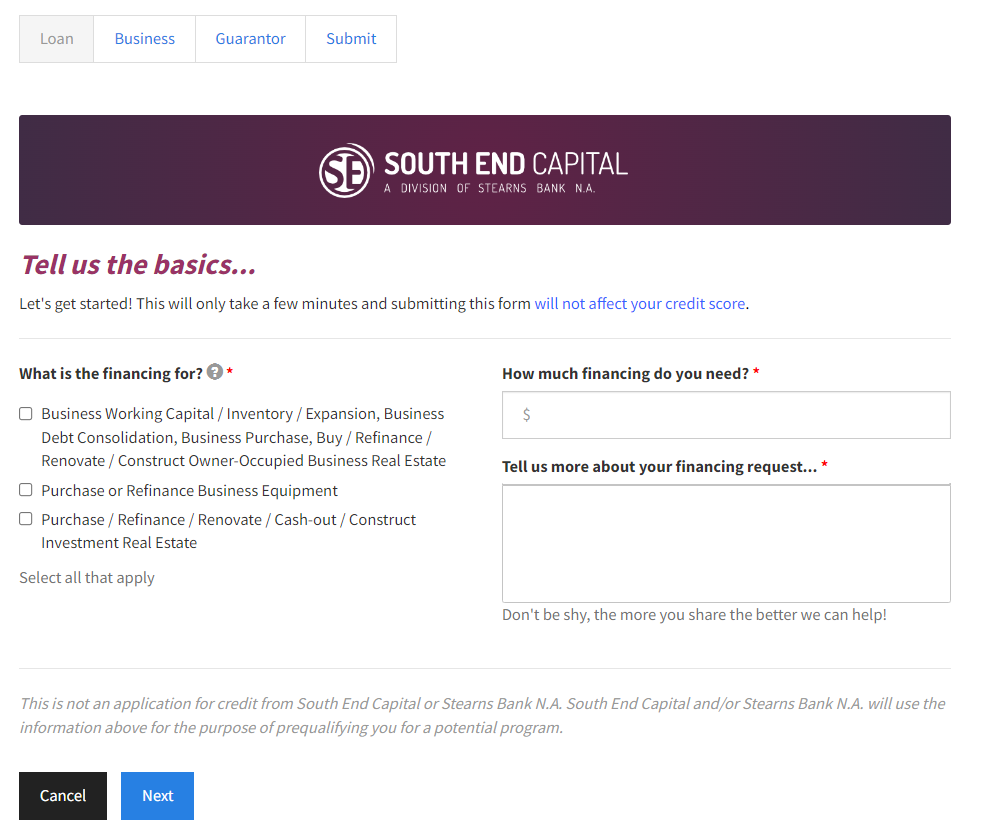

South End Capital Launches Enhanced Online Prequalification Form for Swift Financing Access

October 23, 2023

The industry-leading lender’s improved online prequalification form enables entrepreneurs to submit a financing inquiry in just a few short minutes. ST. CLOUD, MINNESOTA, UNITED STATES, October 23, 2023 /EINPresswire.com/ — South End Capital, a dynamic division of Stearns Bank N.A., proudly announces the release of its upgraded online prequalification form, expediting the process of accessing capital [...]

South End Capital Reintroduces NO FEE SBA 7(a) Loans and Elevates SBA 504 Lending

September 19, 2023

A $2.2 billion preferred SBA lender offers no-fee SBA 7(a) business loans, SBA 504 expertise, and exclusive promotions for small businesses ST. CLOUD, MINNESOTA, UNITED STATES, September 18, 2023/EINPresswire.com/ — South End Capital, a division of Stearns Bank N.A., proudly reintroduces its highly sought-after no-fee SBA 7(a) loans and reduced-fee SBA 504 loans. Leveraging its [...]

Posted: October 28, 2022 | By: LendVer Staff – The question of whether adjustable-rate financing or fixed-rate financing is better may not have you scratching your head—as the benefit of locking in a predictable rate for the long-term may be obvious while the pitfalls of a seemingly volatile rate can be cause for concern. What [...]

How to Get a Disaster Relief Loan

October 5, 2022

Posted: September 30, 2022 | By: LendVer Staff – Hurricane Ian smashed into Florida’s southwest coast Wednesday afternoon as a devastating Category 4 hurricane and by Thursday night left nearly 2 million homes and businesses throughout Florida without power. Hurricane Ian may end up being one of the most powerful storms to ever make landfall [...]